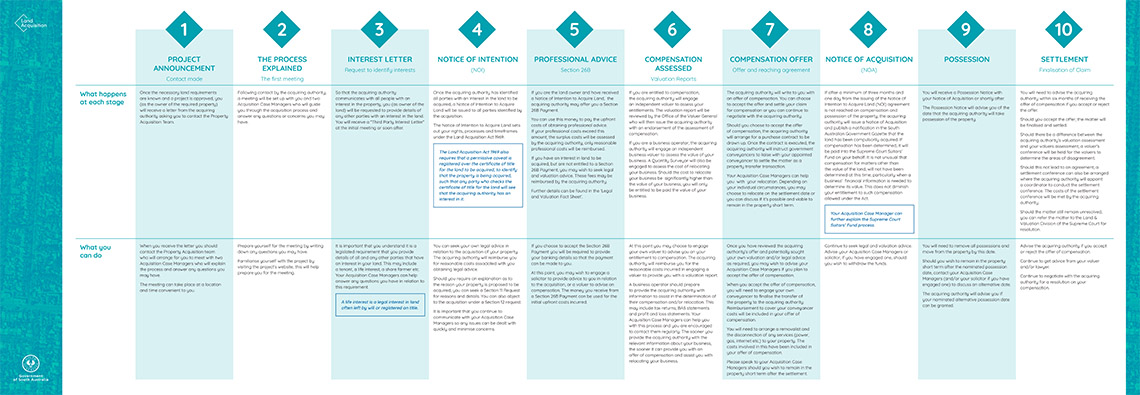

The following ten step acquisition process has been developed to help you (as the owner of the required property) understand what happens at each stage of the property acquisition process and what you can do.

The process is in place so that you:

- have a general overview of the property acquisition process;

- feel prepared and understand what happens at each stage;

- understand your rights and manage discussions around compensation, and;

- are aware you’ll be supported throughout the process and be provided with an Acquisition Case Manager to help navigate your way through each stage.

Case Managers are assigned to help you throughout the process. The acquiring agency will provide you with a Case Manager, who can give you practical advice to suit your circumstances.

The following ten-step acquisition process has been developed to help you (as the owner of the required property) understand what happens at each stage of the property acquisition process and what you can do.

The process is in place so that you:

- have a general overview of the property acquisition process;

- feel prepared and understand what happens at each stage;

- understand your rights and manage discussions around compensation, and;

- are aware you’ll be supported throughout the process and be provided with an Acquisition Case Manager to help navigate your way through each stage.

Case Managers are assigned to help you throughout the process. The acquiring agency will provide you with a Case Manager, who can give you practical advice to suit your circumstances.

Project announcement: Contact made

What happens

Once the necessary land requirements are known and a project is approved, you (as the owner of the required property) will receive a letter from the acquiring authority asking you to contact the Property Acquisition Team.

What you can do

When you receive the letter you should contact the Property Acquisition team who will arrange for you to meet with two Acquisition Case Managers who will explain the process and answer any questions you may have.

The meeting can take place at a location and time convenient to you.

The process explained: The first meeting

What happens

Following contact by the acquiring authority, a meeting will be set up with you and two Acquisition Case Managers who will guide you through the acquisition process and answer any questions you may have.

What you can do

Prepare yourself for the meeting by writing down any questions you may have.

Familiarise yourself with the project by visiting the project's website, this will help prepare you for the meeting.

Interest letter: Request to identify interests

What happens

So that the acquiring authority communicates with all people with an interest in the property, you (as owner of the land) will be requested to provide details of any other parties with an interest in the land. You will receive a "Third Party Interest Letter" at the initial meeting or soon after.

What you can do

It is important that you understand it is a legislated requirement that you provide details of all and any other parties that have an interest in your land. This may include a tenant, a life interest, a share farmer etc. Your Acquisition Case Managers can help answer any questions you have in relation to this requirement.

A life interest is a legal interest in land often left by will or registered on title.

Notice of Intention (NOI)

What happens

Once the acquiring authority has met with you, a Notice of Intention to Acquire Land will be issued to you. You will have 14 days from receipt of the NOI to provide the acquiring authority with details of any other interests in the land.

The Notice of Intention to Acquire Land sets out your rights, processes and timeframes under the Land Acquisition Act 1969.

The Land Acquisition Act 1969 also requires that a permissive caveat is registered over the certificate of title for the land to be acquired, to identify that the property is being acquired, such that any party who checks the certificate of title for the land will see that the acquiring authority has an interest in it.

What you can do

You can seek your own legal advice in relation to the acquisition of your property. The acquiring authority will reimburse you for reasonable costs associated with you obtaining legal advice.

Should you require an explanation as to the reason your property is proposed to be acquired, you can seek a Section 11 Request for reasons and details. You can also object to the acquisition under a Section 12 request.

It is important that you continue to communicate with your Acquisition Case Managers so any issues can be dealt with quickly and minimise concerns.

Professional advice: Section 26B

What happens

If you are the land owner and have received a Notice of Intention to Acquire Land, the acquiring authority may offer you a Section 26B Payment.

You can use this money to pay the upfront costs of obtaining professional advice. If your professional costs exceed this amount, the surplus costs will be assessed by the acquiring authority, only reasonable professional costs will be reimbursed.

If you have an interest in land to be acquired, but are not entitled to a Section 26B Payment, you may wish to seek legal and valuation advice. These fees may be reimbursed by the acquiring authority.

Further details can be found in the 'Legal and Valuation Fact Sheet'.

What you can do

If you choose to accept the Section 26B Payment you will be required to provide your banking details so that the payment can be made to you.

At this point, you may wish to engage a solicitor to provide advice to you in relation to the acquisition, or a valuer to advise on compensation. The money you receive from a Section 26B Payment can be used initial upfront costs incurred.

Compensation assessed: Valuation reports

What happens

If you are entitled to compensation, the acquiring authority will engage an independent valuer to assess your entitlements. The valuation report will be reviewed by the Office of the Valuer General who will then issue the acquiring authority with an endorsement of the assessment of compensation.

If you are a business operator, the acquiring authority will engage an independent business valuer to assess the value of your business. A Quantity Surveyor will also be engaged to assess the cost of relocating your business. Should the cost to relocate your business be significantly higher than the value of your business,

you will only be entitled to be paid the value of your business.

What you can do

At this point you may choose to engage your own valuer to advise you on your entitlement to compensation. The acquiring authority will reimburse you for the reasonable costs incurred in engaging a valuer to provide you with a valuation report.

A business operator should prepare to provide the acquiring authority with information to assist in the determination of their compensation and/or relocation. This may include tax returns, BAS statements and profit and loss statements. Your Acquisition Case Managers can help you with this process and you are encouraged to contact them regularly. The sooner you provide the acquiring authority with the relevant information about your business, the sooner it can provide you with an offer of compensation and assist you with relocating your business.

Compensation offer: Offer and reaching agreement

What happens

The acquiring authority will write to you with an offer of compensation. You can choose to accept the offer and settle your claim for compensation or you can continue to negotiate with the acquiring authority.

Should you choose to accept the offer of compensation, the acquiring authority will arrange for a purchase contract to be drawn up. Once the contract is executed, the acquiring authority will instruct government conveyancers to liaise with your appointed conveyancer to settle the matter as a property transfer transaction.

Your Acquisition Case Managers can help you with your relocation. Depending on your individual circumstances, you may choose to relocate on the settlement date or you can discuss if it's possible and viable to remain in the property short term.

What you can do

Once you have reviewed the acquiring authority's offer and potentially sought your own valuation and/or legal advice as required, you may wish to advise your Acquisition Case Managers if you plan to accept the offer of compensation.

When you accept the offer of compensation, you will need to engage your own conveyancer to finalise the transfer of the property to the acquiring authority. Reimbursement to cover your conveyancer costs will be included in your offer of compensation.

You will need to arrange a removalist and the disconnection of any services (power, gas, internet etc.) to your property. The costs involved in this have been included in your offer of compensation.

Please speak to your Acquisition Case Managers should you wish to remain in the property short term after the settlement.

Notice of Acquisition (NOA)

What happens

If an agreement is not reached on compensation after a minimum of three months and one day from issuing NOI, the acquiring authority may issue a Notice of Acquisition (NOA) and publish a notification in the South Australian Government Gazette that the land has been compulsorily acquired (whilst the acquiring authority cannot issue an NOA for a minimum of three months from the date of the NOI, the NOA can be served later than this should circumstances and individual project timeframes allow).

If compensation has been determined, it will be paid into the Supreme Court Suitors’ Fund on the owner’s behalf.

It is not unusual that compensation for matters other than the value of the land, will not have been determined at this time, particularly when a business' financial information is needed to determine its value. This does not diminish your entitlement to such compensation allowed under the Act.

Your Acquisition Case Manager can further explain the Supreme Court Suitors' Fund process.

What you can do

Continue to seek legal and valuation advice. Advise your Acquisition Case Managers or solicitor, if you have engaged one, should you wish to withdraw the funds.

Possession

What happens

You will receive a Possession Notice with your Notice of Acquisition or shortly after.

The Possession Notice will advise you of the date that the acquiring authority will take possession of the property.

What you can do

You will need to remove all possessions and move from the property by this date.

Should you wish to remain in the property short term after the nominated possession date, contact your Acquisition Case Managers (and/or your solicitor if you have engaged one) to discuss an alternative date.

The acquiring authority will advise you if your nominated alternative possession date can be granted.

Settlement: Finalisation of claim

What happens

You will need to advise the acquiring authority within six months of receiving the offer of compensation if you accept or reject the offer.

Should you accept the offer, the matter will be finalised and settled.

Should there be a difference between the acquiring authority's valuation assessment and your valuers assessment, a valuer's conference will be held for the valuers to determine the areas of disagreement.

Should this not lead to an agreement, a settlement conference can also be arranged where the acquiring authority will appoint a coordinator to conduct the settlement conference. The costs of the settlement conference will be met by the acquiring authority.

Should the matter still remain unresolved, you can refer the matter to the Land & Valuation Division of the Supreme Court for resolution.

What you can do

Advise the acquiring authority if you accept or reject the offer of compensation.

Continue to get advice from your valuer and/or lawyer.

Continue to negotiate with the acquiring authority for a resolution on your compensation.

Resources and publications

What to expect - a step-by-step guide to the acquisition process (PDF, 432.8 KB)

10 step acquisition process (PDF, 432.8 KB)

10 step acquisition process (PDF, 432.8 KB)